Quicken 2007 is capable of producing dozens of different reports, all of which are customizable.

I've tracked my income and expenses with Quicken intermittently during the past thirteen years. (That wouldn't happen until October of 2004.) I was still maxing out my credit cards, still living paycheck to paycheck, and still wondering why I had suck rotten luck. My records go back to when I was married to Kris and we were living in the small town where I grew up. That said, I have transactions in my Quicken datafile going back to 19 February 2004 - almost thirteen years ago!

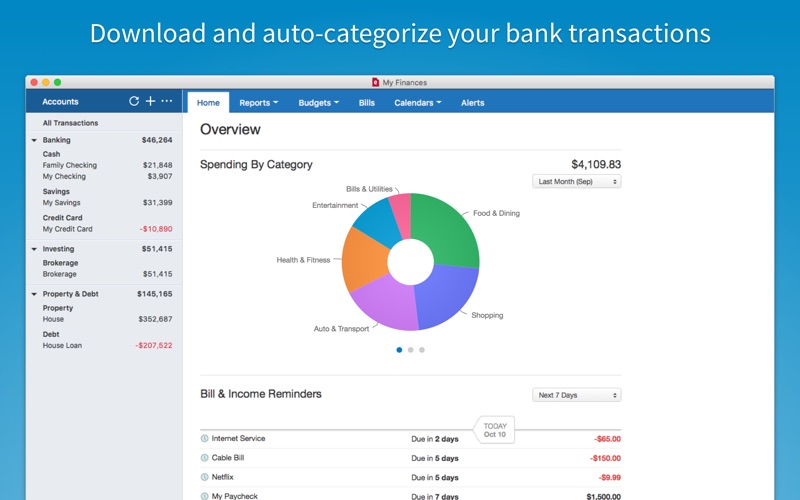

I used it to track my descent into debt during the 1990s, although those files are exiled to inaccessible 3-1/2 inch floppy disks. Quicken 2007įor years, my personal-finance tool of choice has been Quicken. Today I'll talk about Quicken.Īnd at the end of this article, I'll reveal how I've decided to track my money during 2017. Yesterday I compared Mint and Personal Capital. Rather than try every available app, I elected to take a look at four that seemed like good fits for me: Quicken, You Need a Budget, Personal Capital, and Mint.Įarlier this week, I reviewed my experience with You Need a Budget. Lately, however, there's been a boom in personal-finance tools. In the olden days, there weren't many options. As I prepare to track my spending in 2017, I have to decide which tool to use. Welcome to the final day of my mini series exploring popular personal-finance apps.

0 kommentar(er)

0 kommentar(er)